PART 3: how do i build good credit?

|

TYPES OF CREDIT

Your credit scores improve if you have different types of credit, such as auto loans, credit cards, student loans, etc. |

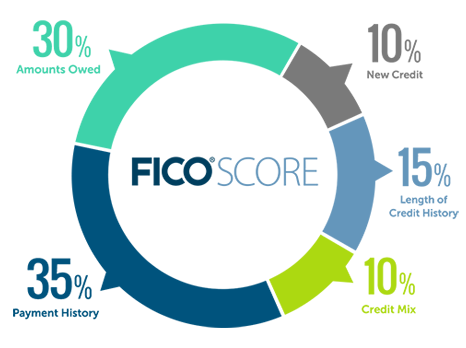

The top things that affect your credit score...

PAYMENT HISTORY The most important thing is that you pay all of your bills on time. Any missed or late payments have a negative impact on your credit score. Keep in mind that this may apply to many of your bills, not just loans and credit cards. CREDIT HISTORY How long you've been using credit also matters. The longer, the better. So if you are new to credit or rebuilding credit, start building a good credit history now. CREDIT USAGE (CU) - It's the percentage of how much of your credit you use each month. If it gets to high, it can negatively affect your credit score. |

Tips for maintaining good credit...

|

PAY ON TIME

Late payments will negatively impact your ability to get credit in the future and are the first signs of impending credit problems. KEEP YOUR BALANCES LOW

If your balances are close to the limit on your credit card(s), it shows you are using all of the credit you have been given. This may be seen as risky and can negatively impact credit scores. PAY MORE THAN THE MINIMUM

If you pay more than the minimum, it will help keep your overall balances down. Also, you will pay less interest if you are able to pay more of the balances. SET UP AUTOMATIC PAYMENTS OF ALERTS

Both can help you make sure you never accidentally miss a payment. Automatic payments are electronic payments transferred from another account, like a checking account, before they're due. You can also set up email or text alerts from your online banking account as reminders when payments are due. |

KEEP LONG-STANDING ACCOUNTS OPEN

Closing longstanding accounts may have a greater negative impact on your credit score than keeping them open. Closing an account lowers the amount of total credit you have, which can raise the ratio of how much you ow vs. the total credit you have available. AVOID TOO MANY NEW CREDIT ACCOUNTS

Every time you attempt to open an account, it appears on your credit history. Lenders may see it as a risk if you're applying for credit too often. Also, having more credit cards can be a temptation to overspend. CHECK YOUR CREDIT HISTORY OFTEN

You can check your personal credit history as often as you like without affecting your credit scores. You can get a copy once per year for free at annualcreditreport.com. MAKE A BUDGET AND LIVE BY IT

The best way to make sure you are able to keep up with your bills is to closely monitor your spending. Creating a budget can help you decide when to use credit and when to hold off on a purchase. |

How long does it take to build good credit???

Each person's situation is different, so there is not exact answer to how long it will take to build your credit. It's better to think of it as an ongoing process that you should always be working to improve. However, clients who remain in our system for at least 6 months see a drastic increase in their credit score. Remember that your credit score takes into account a whole bunch of information, and much of it takes time to affect your score. This just makes it more important that you work to build your credit wisely.